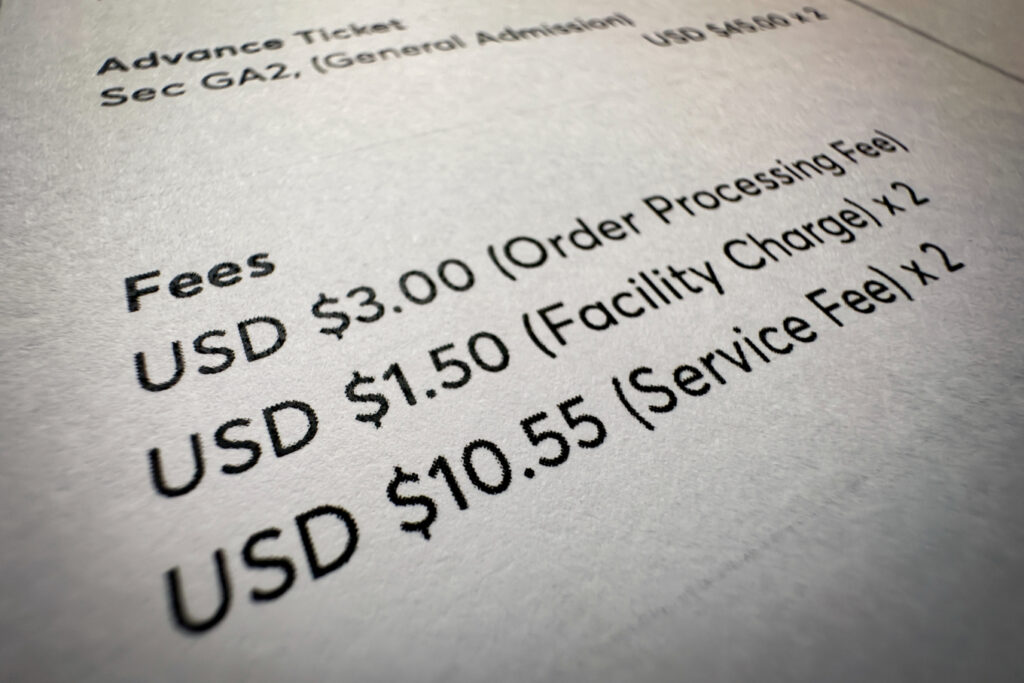

Online shopping offers unmatched ease from your phone to your front door, it doesn’t get more convenient. But while digital retail has become a staple in our lives, it also comes with a quiet cost: hidden “junk fees” that inflate your final total without warning.

According to Gidon Sadovsky, CEO of Overnight Glasses, an online store for prescription eyewear, shoppers often overpay by overlooking small but consistent traps at checkout. “It’s not about one big fee,” he explains. “It’s the small charges that add up, especially for frequent online shoppers.”

Here are the top five hidden fees to watch out for and how to avoid them:

1. Uncheck Gift Wrapping, Rush Processing, and Other Auto-Selected Add-Ons

Retailers often sneak in optional extras by pre-checking boxes during checkout. These can include gift wrapping, extended warranties, or rush processing.

A survey by the Better Business Bureau found that 29% of shoppers paid for services they didn’t want simply because they didn’t uncheck a box.

“People speed through checkout,” says Sadovsky, “and don’t realize they’ve agreed to add-ons. A few dollars here and there, over time, can become hundreds.”

2. Shop in Incognito Mode to Avoid Dynamic Pricing

Dynamic pricing means the cost of an item can change based on your browsing history, location, or even device. Repeat visitors or users from higher-income zip codes may be shown higher prices.

“Try shopping in incognito mode to get a neutral view,” advises Sadovsky. Research from Northeastern University shows price fluctuations of up to 20% depending on your digital footprint.

3. Read the Return Policy to Avoid Restocking and Return Shipping Fees

Many people assume returns are free, but that’s not always the case. Some online stores charge restocking fees or make you cover the shipping.

A National Retail Federation report showed **U.S. shoppers lost over \$9 billion last year to return-related charges.

“Don’t wait until after the purchase to find out the return costs,” says Sadovsky. “It could significantly cut into your refund.”

4. Check Your Credit Card Perks Before Buying a Product Warranty

Extended warranties are a popular upsell, but in many cases, they’re redundant.

“Most credit cards already include purchase protection,” says Sadovsky, “and many products come with a manufacturer’s warranty.”

Consumer Reports found that 55% of shoppers never used the warranty they paid for, and 38% already had coverage elsewhere.

5. Review the Shipping Terms. Don’t Assume “Free” Means Free

We’ve all clicked “buy” thinking we qualified for free shipping, only to discover it didn’t apply.

Sadovsky notes that free shipping often comes with conditions like **minimum spending thresholds or location-based restrictions.

According to Statista, **61% of abandoned shopping carts** are due to unexpected shipping fees.

Final Expert Take: Slow Down and Simulate Your Checkout

“Most hidden fees only appear at the very end of the checkout process,” says Sadovsky.

His advice is, “Add the item to your cart, go through checkout until the final screen, and watch for surprise fees. Then close the tab and compare prices elsewhere.”

That extra 60 seconds can make a big difference in what you spend.

Whether you’re buying a new pair of glasses or filling your cart with summer fits, the real cost of convenience can sneak up on you.

Stay alert, shop smart, and keep more money in your pocket because financial finesse is always in style.

Also Check Out

Leave a Reply